By Vasilis Pappas, Senior Meteorologist at MET Group

Natural gas has an increasing share in the overall energy mix in Europe, as part of the coal phase-out and gas being used as a transition fuel in the green transition. It means that weather can have a significant effect on gas demand.

This was the case for winter 2024-2025. Q4 2024 saw temperatures close to the average of the previous 5 years for Northwest Europe, but they were lower in South-Eastern and Central-Eastern Europe by 1.5 C and 0.6 C respectively. Although these temperatures still qualify as above the 1991-2020 average (by 1.3 C according to Copernicus for the October24-February25 period), they were low enough to cause strong withdrawals from gas storages.

Another crucial component in the energy transition mix is the production from renewable energy sources (wind, solar, hydro). Despite the significant addition of wind and solar energy capacity, wind has underperformed in Q1 2025 in both Southeast and Northwest Europe.

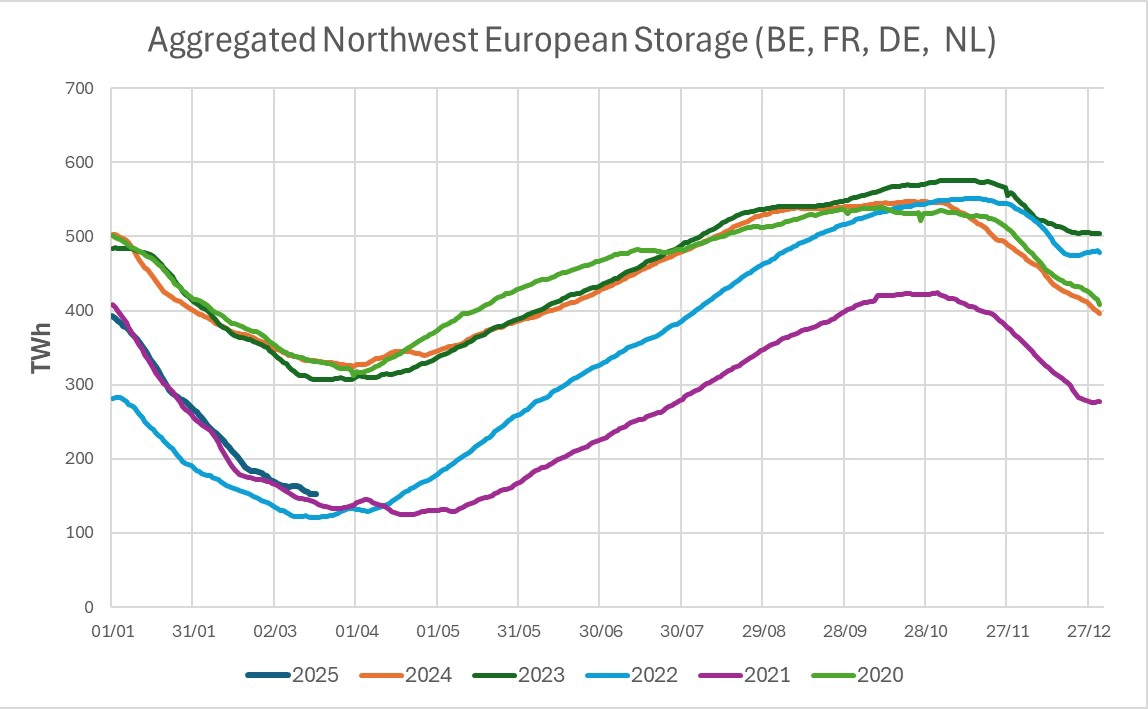

A number of short-lived Dunkelflaute events, during which high demand coincided with very low levels of solar and wind generation, sharpened the withdrawals and widened the deficit of gas inventories from the average of the past 5 years. At the time of writing (15 March 2025), the accumulated EU gas inventories are 36.2% full, compared to 60.32% last year and 43.3% average over the past 5 years.

Hydro power is often used during the expensive hours in winter, thanks to its flexible generation. Looking at the levels of hydro reservoirs around Europe at the end of February, they are the lowest for the past at least 5 years (for some regions in the past 20 years) for Central and Eastern Europe (including Austria, Switzerland and Romania), while in Western Europe the situation is better. It is remarkable that the Danube level in Budapest exceeded 800 cm (above Adriatic reference point) at the end of September 2024, leading to severe flooding in the region, but at the time of writing it is only 100 cm.

Whilst the risk for short cold outbreaks is not over yet in Europe, there are additional concerns in the gas markets for the restocking of gas storages in order to reach the 90% EU requirement by the beginning of November. Apart from the fact that gas flowing from Russia this year has been even less than last year, we also need to consider the summer season, where cooling demand has been steadily increasing due to more intense and longer heatwaves, especially in Southern Europe.