In a recent business development, Swiss-based European energy company MET Group has acquired a 100% stake in a 42-megawatt wind park in Bulgaria, after signing a share purchase agreement with Italian Enel Green Power. The closing of the transaction is expected to take place before the end of December 2020.

When considering the percentage of renewable components in the energy grid, it is clear that the energy transition in the CEE region is still in its early stages. Yet EU incentives, consumer pressure and industry demands in CEE are all increasing the speed of this transition.

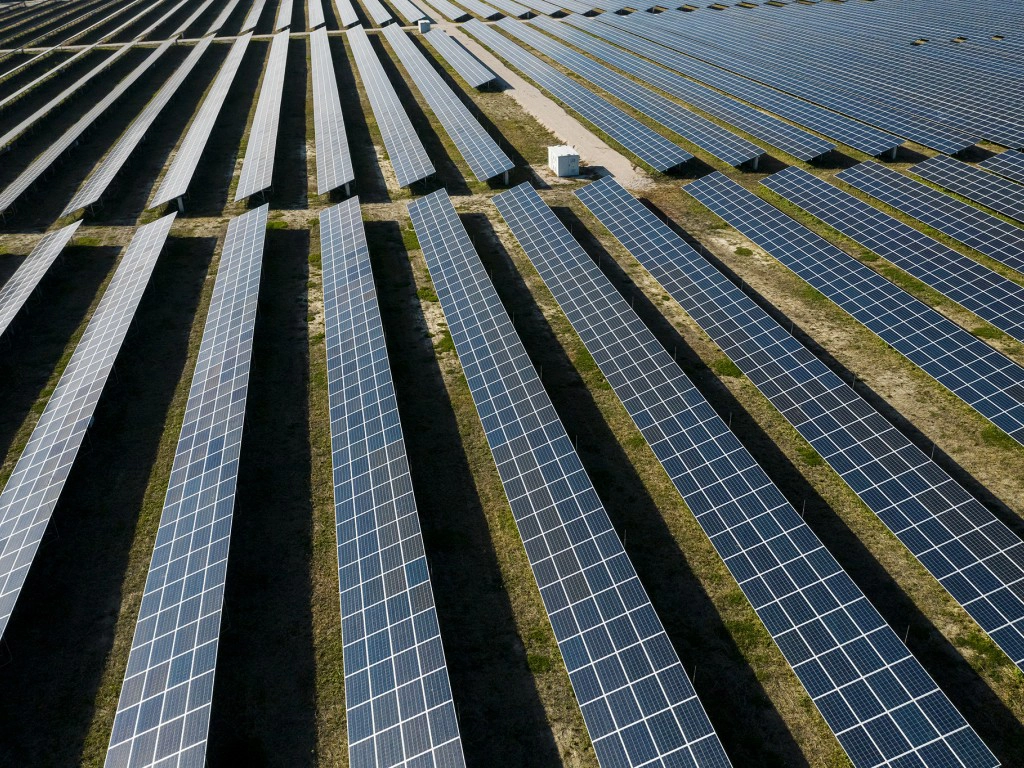

MET Group understands this shift and is thus aiming to build a diversified renewable energy production portfolio of several hundred megawatts in Central and Eastern Europe by 2023 (mainly in solar and on-shore wind projects). MET’s Group CFO Johannes Niemetz explains: “Due to the mature Western European renewable landscape, MET is fully focusing on its core competence in the CEE region.”

MET is present in several markets of the CEE region (Romania, Croatia, Serbia, Bulgaria, Turkey, Ukraine). Regardless of the regional differences within Central and Eastern Europe, there is one common pattern – illiquidity and market growth are still greater than in Western Europe. Mr. Niemetz believes that MET Group is more likely to invest in Central and South-eastern Europe than most big energy firms.“We understand certain market dynamics better than our larger competitors. We are independent and flexible, so we can adapt more quickly to local market conditions within our integrated model, while operating very comfortably within the CEE region where we have a strong track record already.”

MET Group’s strategy is to become a truly integrated energy company, across its sales, trading and asset divisions. Mr. Niemetz comments: “The success of MET revolves around having competitive power and sales portfolios in Central and Eastern Europe, understanding local balancing markets and being present for the long term.”

The CEE region also has a significantly lower renewables component in its energy mix, with technologies around grid management and parity underdeveloped as compared to Germany or Italy for example. Due to this, the growth of renewables is a key focus of MET’s asset strategy.

“Investments in the renewable sector in the CEE region is truly part of our core strategy,” stresses Johannes Niemetz. “Given our regional and strategical focus, we add value from a renewables perspective mainly in the CEE region around onshore wind and solar.”

The renewable component is a growing part of MET’s portfolio. In addition to the acquired 42-megawatt wind park in Bulgaria, the 43 MW Kabai Solar Park (located in Hungary) started commercial operation in October 2020. Renewable growth is a complimentary fit to MET Group’s core competence in natural gas (the company having traded 50 billion cubic meters (BCM) or around 10% of total European consumption in 2019).

MET is 80% owned by the management and 20% by Singapore-based Keppel Corporation. Through Keppel, it has established a strategic platform to jointly explore investment opportunities across European energy infrastructure assets. As MET Group is not a state player anywhere, its independence allows quicker decision-making and more flexibility.

Source: SeeNews